Explain the Difference Between a Direct and Indirect Tax

Best answer Direct tax is the tax whose liability to pay and incidence lies on the same person on whom it is levied. Retailers from the ultimate taxpayer ie.

Difference Between Direct And Indirect Taxes Introduction To Indire

The federal government spent more than it took in each year and.

. Difference between a Direct Tax and Indirect Tax. It is applicable to taxpayer. The income tax burden is equitably distributed on different people and institutions.

Must be paid directly to the government by the person on whom it is imposed Indirect. Direct and Indirect Expenses. It is then the responsibility of the intermediary.

However the implications of these taxes are quite extensive and complex so you should consider contacting an audit firm so that you can enjoy the reliable efficient and professional services of accountants and auditors and claim tax incentives in Singapore. It includes good allocative effects less burden. The allocative effects of direct taxes are superior to those of indirect taxes.

It has high administrative cost. Thereby the tax burden falls more on the rich than on the poor. Indirect tax is the tax whose liability to pay and incidence lies on different persons.

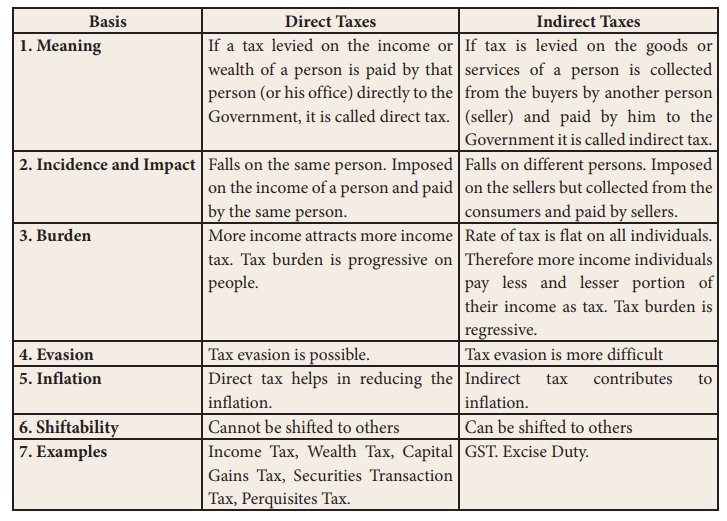

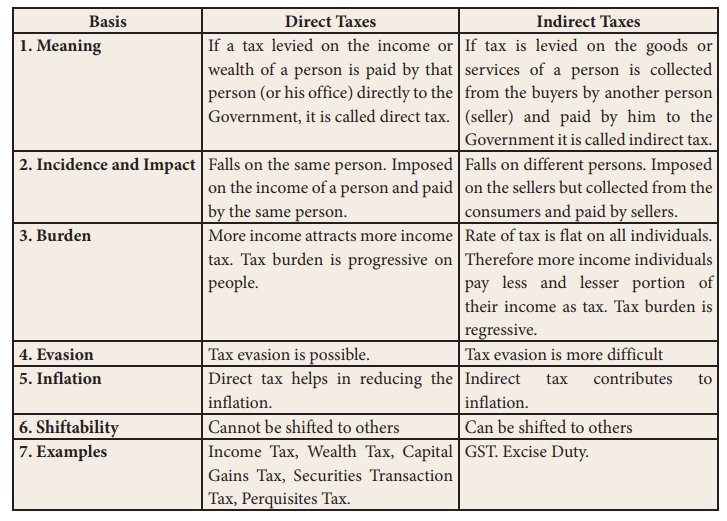

Explain the difference between Direct Tax and Indirect Tax. Whereas indirect tax is ultimately paid for by the end-consumer of goods and services. Direct Tax is progressive in nature as it is based on the percept of ability to pay.

Adding an extra amount to the products total price will restrict them from. It is the tax on incomeprofits. They can either be directly or indirectly related to the core business operations.

These taxes cannot be shifted to any other person or group. Every individual who is not familiar that they are paying the tax will contribute to pay it. The indirect tax rates vary from product to product.

Therefore the burden of paying them can be put on another persons shoulders. Indirect tax is tax collected by intermediaries for eg. Amount of taxation depends on income and profits generated by individual Tax imposed is to be same for all category of people 4.

Get the answers you need now. The process that occurs when a tax that has been levied on one person or group is in fact paid by others. It is imposed on the income of a person based on the principle of ability to pay.

Individuals firms companies pay direct taxes. An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it. A direct tax is untransferable to other entities while an indirect tax is transferable.

Direct tax is imposed directly on the taxpayer and is paid by the taxpayer directly to the government. So the tax is imposed more on the rich and less on the poor. Material and labor are included in the direct costs of any manufacturing concern.

Some expenses are direct to the core product or service of the business. The Government can influence allocation of resources for production of different goods and services through its budget. Explain the difference between a direct tax and an indirect tax.

It covers an entityindividual. Paid first by one person but then passed onto another. Direct taxes refer to taxes that are filed and paid by an individual directly to the government.

Taxes can be either direct or indirect. Indirect taxes on the other hand are taxes that can be transferred to another entity. Tax evasion is possible.

While Direct tax is levied on the assessee which may include Individual HUF Company AOP BOI etc. While other expenses are incurred for selling the products and are not directly part of the production process. Examples of direct and indirect expenses.

A tax that cannot be shifted to others such as the federal income tax. Type of an expense and Timing at which it is incurred by the business frames the key points of difference between direct and indirect expenses. It is imposed on all goods and services.

It is to be paid by Individuals and businesses organizations. It is burden on individual. The incidence and impact of the tax is on different persons.

1 See answer CrizMack7229 is waiting for your help. Add your answer and earn points. The indirect tax helps in controlling the product purchase.

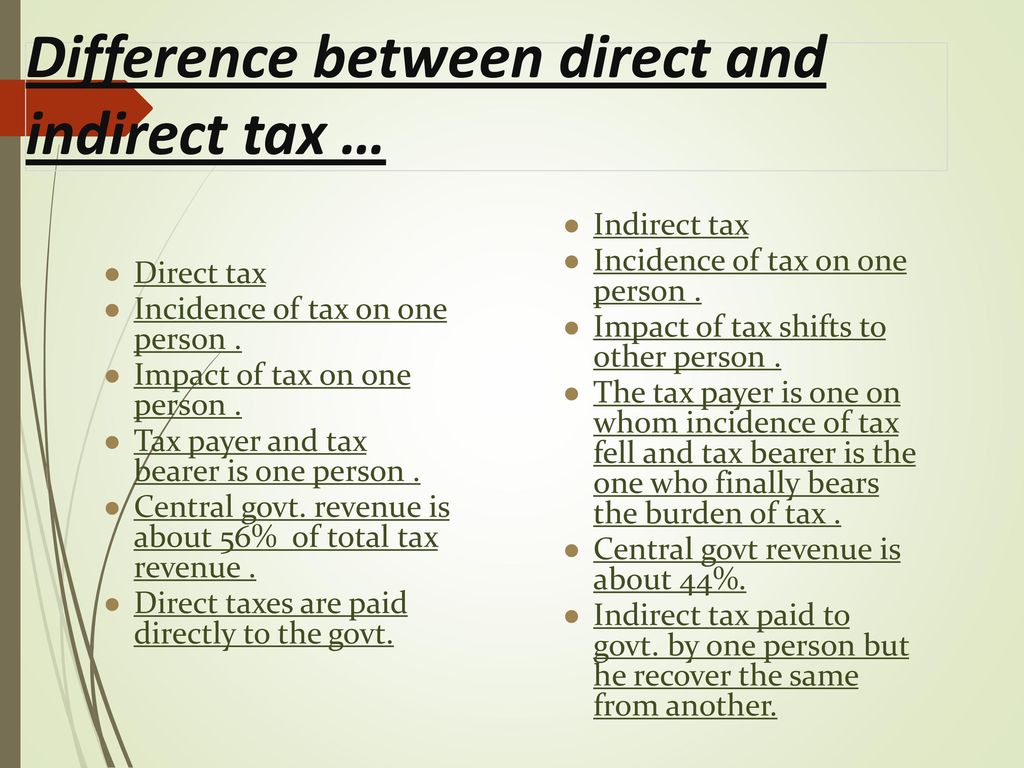

How does deficit financing lead to public debt. The incidence and impact of the tax is on the same person. The difference between a direct tax is one that must be paid directly to the government by the person on whom it is imposed and indirect tax is one first paid by one person but then passed on to another.

Key differences between Direct and Indirect Tax are Direct tax is levied and paid for by individuals Hindu undivided Families HUF firms companies etc. 1 It is imposed on income and profits. Direct taxes are progressive and they help to reduce.

A tax that can be shifted to others such as business property taxes. A direct tax is one that the taxpayer pays directly to the government. The evasion of tax is possible in case of a direct tax if the proper administration of the collection is not done but in the case of indirect tax the evasion of tax is not possible since the amount of tax is charged on the goods and services.

The main difference between the direct and indirect tax is that the burden of direct tax cannot be shifted whereas the burden of indirect tax can be shifted. This is because the direct taxes are charged on the income of an individual income of the company or taxes or property owned. It cant be transferred to others.

A major difference between direct and indirect tax is the fact that while direct tax is directly paid to the government there is generally an intermediary for collecting indirect taxes from the end-consumer. Unlike a direct tax indirect tax involves every citizen paying the tax in a minimum amount. The second difference is that direct taxes happens and effects one person while indirect taxes happens from a different person while the impact is felt by another.

On the other hand indirect taxes are received from an individual who is not the. Expenses are amounts paid for goods or services purchased. Indirect Tax is paid by the final consumer.

Hence the impact and incidence of taxes are. While direct taxes are imposed on income and profits indirect taxes are levied on goods and services. CrizMack7229 CrizMack7229 02042019 Business Studies Secondary School answered Explain the difference between Direct Tax and Indirect Tax.

The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who then pays it to the government. The burden of tax cannot be shifted in case of direct taxes while burden can be shifted for indirect taxes. What is Indirect Tax.

Direct taxes can be evaded in the absence of proper collection administration. A business entity is incurring different expenses direct and indirect to keep the cycle running. It is imposed on an individual but is paid by another person either partly or wholly.

It is to be paid by End-consumers.

What Is The Difference Between Direct And Indirect Tax Quora

Differences Between Direct Taxes And Indirect Taxes

Topic Introduction Of Tax And Difference B W Direct And Indirect Tax Ppt Download

0 Response to "Explain the Difference Between a Direct and Indirect Tax"

Post a Comment